RiskReversal Pod – Details, episodes & analysis

Podcast details

Technical and general information from the podcast's RSS feed.

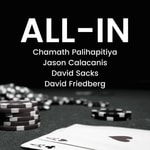

RiskReversal Pod

RiskReversal Media

Frequency: 1 episode/2d. Total Eps: 815

Recent rankings

Latest chart positions across Apple Podcasts and Spotify rankings.

Apple Podcasts

🇺🇸 USA - investing

27/07/2025#95🇺🇸 USA - investing

23/07/2025#100🇺🇸 USA - investing

22/07/2025#100🇺🇸 USA - investing

21/07/2025#85🇺🇸 USA - investing

20/07/2025#71🇺🇸 USA - investing

19/07/2025#71🇺🇸 USA - investing

18/07/2025#88🇨🇦 Canada - investing

17/07/2025#74🇨🇦 Canada - investing

16/07/2025#67🇨🇦 Canada - investing

15/07/2025#49

Spotify

No recent rankings available

Shared links between episodes and podcasts

Links found in episode descriptions and other podcasts that share them.

See allRSS feed quality and score

Technical evaluation of the podcast's RSS feed quality and structure.

See allScore global : 69%

Publication history

Monthly episode publishing history over the past years.

The Market’s Rockin’ and a Conversation with Vincent Daniel and Porter Collins

Episode 311

vendredi 30 août 2024 • Duration 01:11:58

Tech Investor Gene Munster on MegaTrends | Okay, Computer.

mercredi 28 août 2024 • Duration 41:29

A Couple of Talking Heads on GenAI, Crypto & The State of Fintech with Trevor Marshall

mercredi 7 août 2024 • Duration 42:52

The Fab Five and the Nasdaq Have Entered the Blowoff Top Phase

Episode 250

lundi 5 février 2024 • Duration 01:02:48

Market’s Smooth Operator + The Big Short Panel

Episode 249

vendredi 2 février 2024 • Duration 01:03:07

Jim Chanos says this is the Cheapest thing in the Stock Market... | MRKT Call

mercredi 31 janvier 2024 • Duration 32:45

The Fate of the Furious Five | Okay, Computer.

mardi 30 janvier 2024 • Duration 28:47

Mega Earnings Week On Tap with SoFi's Liz Young

Episode 248

lundi 29 janvier 2024 • Duration 27:41

Signs, Signs, Everywhere the Market Signs with Stephanie Link of Hightower Advisors

Episode 247

vendredi 26 janvier 2024 • Duration 01:19:30

New Year, New AI Winners with Gene Munster | Okay, Computer.

mercredi 24 janvier 2024 • Duration 59:28